All Categories

Featured

Table of Contents

A PUAR enables you to "overfund" your insurance coverage right up to line of it ending up being a Changed Endowment Agreement (MEC). When you make use of a PUAR, you swiftly raise your cash money value (and your death benefit), therefore increasing the power of your "financial institution". Better, the even more money value you have, the greater your interest and returns payments from your insurance provider will certainly be.

With the increase of TikTok as an information-sharing system, monetary guidance and strategies have actually located a novel means of spreading. One such technique that has actually been making the rounds is the unlimited banking idea, or IBC for short, amassing recommendations from celebrities like rapper Waka Flocka Flame. While the approach is currently prominent, its roots map back to the 1980s when financial expert Nelson Nash introduced it to the globe.

Who can help me set up Wealth Management With Infinite Banking?

Within these plans, the cash value expands based on a price set by the insurance company (Wealth management with Infinite Banking). Once a significant cash money worth builds up, insurance policy holders can get a cash money worth lending. These lendings vary from conventional ones, with life insurance policy functioning as security, implying one might shed their protection if borrowing exceedingly without appropriate money worth to sustain the insurance policy costs

And while the attraction of these policies is obvious, there are innate restrictions and threats, requiring diligent money worth tracking. The strategy's legitimacy isn't black and white. For high-net-worth individuals or company owner, particularly those making use of techniques like company-owned life insurance coverage (COLI), the benefits of tax obligation breaks and compound growth might be appealing.

The attraction of infinite financial does not negate its difficulties: Expense: The fundamental requirement, an irreversible life insurance policy plan, is more expensive than its term counterparts. Qualification: Not every person gets whole life insurance due to strenuous underwriting processes that can exclude those with certain wellness or lifestyle conditions. Intricacy and threat: The complex nature of IBC, paired with its dangers, might prevent numerous, specifically when easier and much less high-risk alternatives are readily available.

Financial Independence Through Infinite Banking

Designating around 10% of your regular monthly revenue to the policy is simply not feasible for a lot of people. Part of what you review below is simply a reiteration of what has actually currently been claimed above.

Before you obtain yourself right into a situation you're not prepared for, know the complying with initially: Although the principle is generally offered as such, you're not actually taking a financing from on your own. If that were the case, you wouldn't need to repay it. Rather, you're obtaining from the insurer and need to repay it with interest.

Some social media blog posts advise using money value from entire life insurance coverage to pay down credit history card financial obligation. When you pay back the finance, a portion of that interest goes to the insurance coverage business.

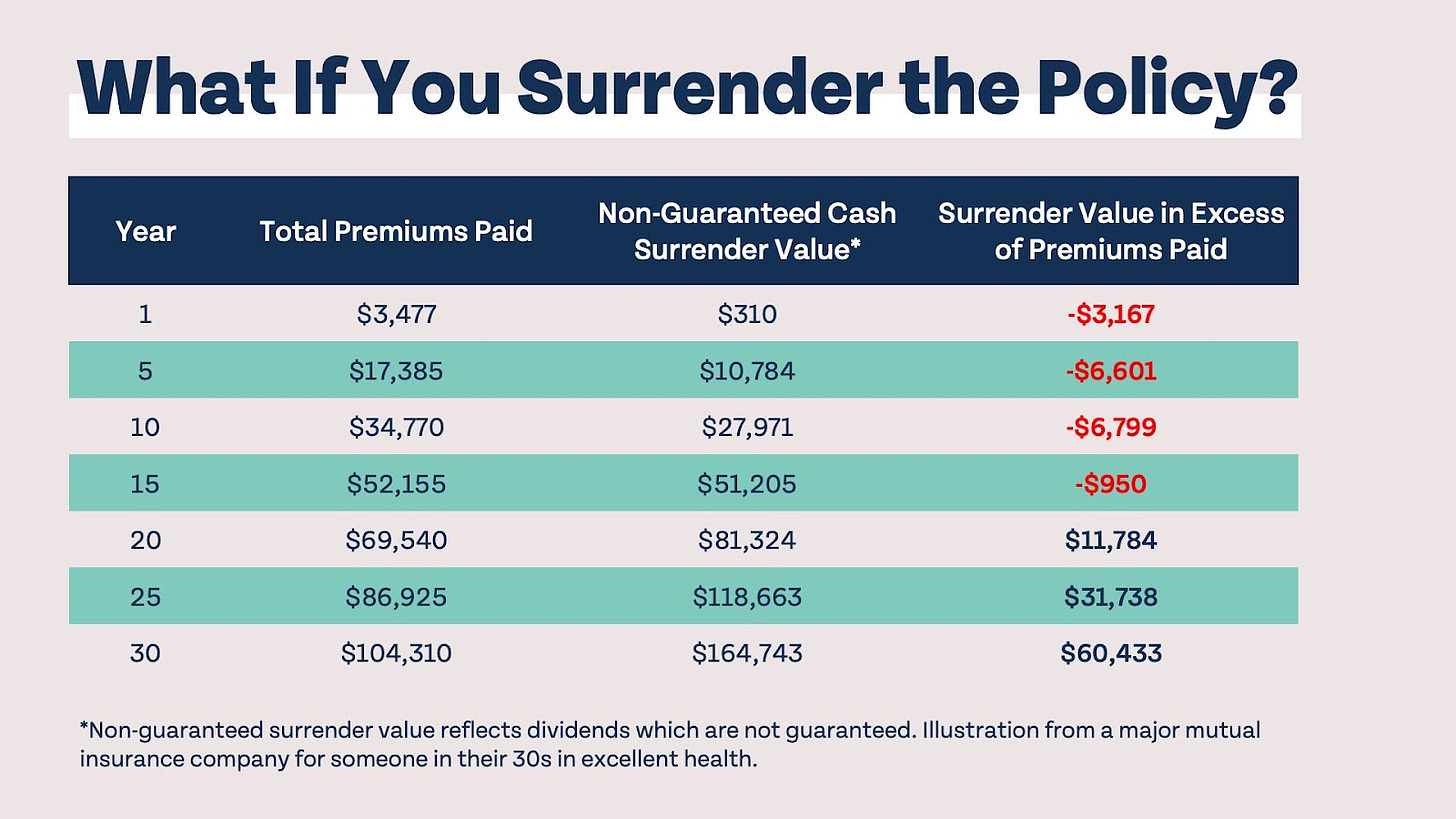

For the first numerous years, you'll be paying off the commission. This makes it very difficult for your policy to build up worth throughout this time. Unless you can afford to pay a couple of to a number of hundred bucks for the next decade or even more, IBC will not function for you.

What are the benefits of using Policy Loans for personal financing?

If you need life insurance, below are some important ideas to think about: Take into consideration term life insurance coverage. Make certain to shop around for the ideal rate.

Picture never having to worry about bank car loans or high rate of interest rates again. That's the power of limitless banking life insurance policy.

There's no set lending term, and you have the liberty to pick the repayment schedule, which can be as leisurely as settling the financing at the time of death. Privatized banking system. This versatility encompasses the maintenance of the lendings, where you can decide for interest-only repayments, keeping the car loan balance level and workable

Holding money in an IUL repaired account being credited passion can frequently be far better than holding the money on down payment at a bank.: You have actually constantly desired for opening your own pastry shop. You can obtain from your IUL policy to cover the preliminary costs of leasing a room, purchasing equipment, and working with personnel.

What are the risks of using Whole Life For Infinite Banking?

Personal finances can be obtained from typical banks and credit report unions. Borrowing money on a credit card is generally extremely costly with annual portion prices of interest (APR) typically reaching 20% to 30% or more a year.

Table of Contents

Latest Posts

Infinite Banking Link

How To Make Your Own Bank

Infinite Banking Agents

More

Latest Posts

Infinite Banking Link

How To Make Your Own Bank

Infinite Banking Agents