All Categories

Featured

Table of Contents

We utilize data-driven approaches to evaluate monetary products and solutions - our evaluations and scores are not influenced by marketers. Unlimited financial has caught the rate of interest of lots of in the personal finance globe, assuring a path to monetary liberty and control.

Boundless banking refers to an economic approach where a private becomes their own lender. This principle rotates around making use of entire life insurance policy policies that accumulate cash money worth over time. The insurance holder can obtain against this cash money value for various economic demands, properly loaning cash to themselves and paying off the policy by themselves terms.

This overfunding increases the growth of the plan's cash money value. The insurance policy holder can then borrow against this money value for any type of function, from financing a vehicle to investing in genuine estate, and after that settle the funding according to their very own timetable. Limitless banking supplies many advantages. Here's a take a look at a few of them. Infinite Banking for financial freedom.

What are the most successful uses of Wealth Building With Infinite Banking?

Right here are the response to some inquiries you could have. Is limitless financial legit? Yes, unlimited banking is a legitimate technique. It includes using an entire life insurance coverage policy to create an individual financing system. Nonetheless, its effectiveness depends on various factors, consisting of the plan's structure, the insurer's efficiency and how well the method is handled.

It can take a number of years, typically 5-10 years or even more, for the money value of the plan to grow completely to begin borrowing versus it properly. This timeline can vary depending on the policy's terms, the costs paid and the insurance policy company's performance.

What happens if I stop using Leverage Life Insurance?

So long as costs are present, the policyholder just calls the insurer and requests a lending against their equity. The insurance provider on the phone won't ask what the lending will be used for, what the earnings of the debtor (i.e. insurance policy holder) is, what various other properties the individual could need to function as security, or in what timeframe the individual means to repay the car loan.

In contrast to term life insurance policy items, which cover only the recipients of the policyholder in the event of their death, entire life insurance coverage covers a person's whole life. When structured properly, whole life plans create an unique earnings stream that increases the equity in the policy over time. For more analysis on exactly how this works (and on the pros and cons of entire life vs.

In today's world, globe driven by convenience of comfort, intake many also lots of granted our provided's purest founding principlesBeginning freedom and flexibility.

What resources do I need to succeed with Infinite Banking Cash Flow?

It is a principle that enables the insurance policy holder to take loans on the entire life insurance coverage plan. It must be available when there is a minute financial burden on the individual, in which such lendings might aid them cover the financial load.

The insurance holder needs to attach with the insurance firm to ask for a lending on the plan. A Whole Life insurance coverage plan can be labelled the insurance item that offers protection or covers the individual's life.

It begins when a private takes up a Whole Life insurance coverage plan. Such policies maintain their worths because of their conventional technique, and such policies never ever invest in market tools. Boundless banking is a concept that allows the policyholder to take up finances on the entire life insurance coverage plan.

Is Tax-free Income With Infinite Banking a better option than saving accounts?

The money or the abandonment worth of the whole life insurance coverage functions as collateral whenever taken loans. Suppose a private enrolls for a Whole Life insurance coverage plan with a premium-paying term of 7 years and a plan duration of twenty years. The private took the policy when he was 34 years of ages.

The security derives from the wholesale insurance policy's cash money or abandonment worth. These factors on either extreme of the spectrum of truths are gone over below: Limitless financial as a monetary technology enhances money circulation or the liquidity profile of the insurance policy holder.

Infinite Banking Account Setup

The insurance plan funding can also be available when the person is out of work or encountering health and wellness problems. The Whole Life insurance policy preserves its general value, and its efficiency does not connect with market efficiency.

In addition, one need to take only such policies when one is economically well off and can take care of the plans costs. Limitless financial is not a rip-off, however it is the ideal point the majority of people can opt for to boost their financial lives.

Leverage Life Insurance

When people have limitless financial explained to them for the initial time it looks like a magical and risk-free method to expand wealth - Generational wealth with Infinite Banking. The idea of changing the disliked bank with loaning from on your own makes so much even more sense. It does call for replacing the "disliked" financial institution for the "hated" insurance policy firm.

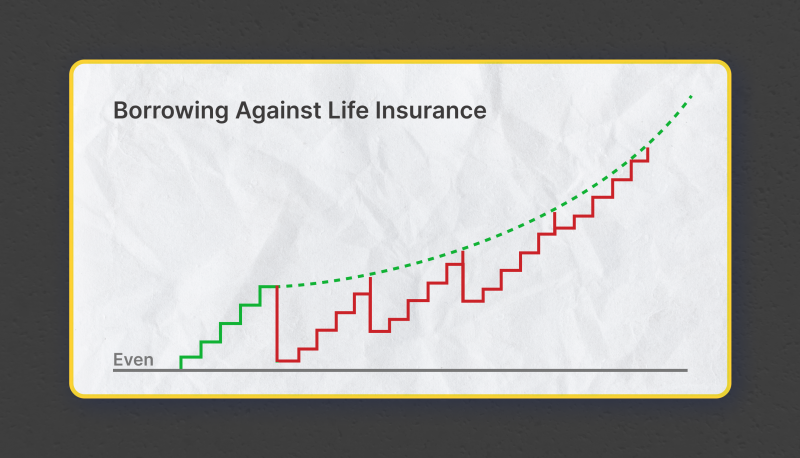

Naturally insurance provider and their representatives like the concept. They designed the sales pitch to offer even more entire life insurance policy. Does the sales pitch live up to genuine world experience? In this short article we will first "do the math" on limitless banking, the bank with on your own philosophy. Since fans of boundless banking could assert I'm being prejudiced, I will use display shots from an advocate's video and connect the whole video at the end of this write-up.

There are two severe monetary calamities built right into the infinite financial idea. I will reveal these defects as we work with the math of just how unlimited banking actually works and exactly how you can do much far better.

Table of Contents

Latest Posts

Infinite Banking Link

How To Make Your Own Bank

Infinite Banking Agents

More

Latest Posts

Infinite Banking Link

How To Make Your Own Bank

Infinite Banking Agents